Canada Raises Stakes in Steel Trade War

Imposes 25% Surtax on Imported Products

On the last day of 2025, Canada made a decisive move in an intensifying global trade battle. As Americans prepared for New Year’s celebrations, the Canadian government quietly registered sweeping new tariff orders that reshape how steel flows across North American borders, signaling a strategic pivot away from passive response to aggressive American protectionism.

The Collision Course

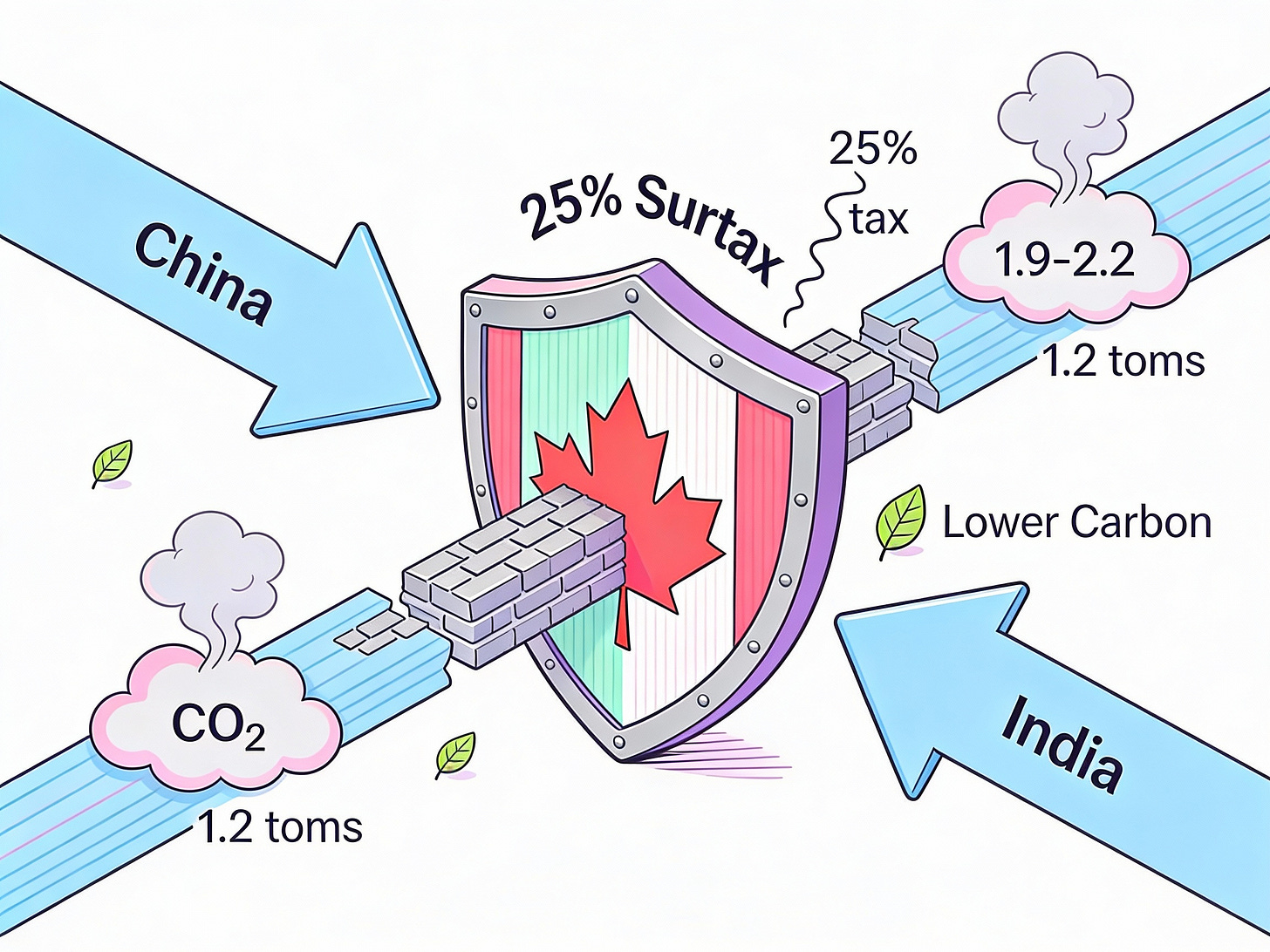

The move comes after months of mounting pressure. Washington’s steel tariffs, imposed under Section 232 of U.S. trade law, have created a fundamental problem for Canadian producers: they’ve lost access to their largest market while simultaneously watching cheap imports flood into Canada from countries like China and India. The arithmetic became brutal: Chinese steel, produced at roughly 1.9 tons of CO2 emissions per ton, and Indian steel at 2.2 tons, proved cheaper than Canadian production at 1.2 tons per ton, despite Canada’s environmental advantage.

For months, stakeholders pleaded with Ottawa. Steel mill producers demanded protection. Steel-consuming industries, from auto manufacturers to construction firms, sought exemptions. Union leaders warned of job losses. Provinces raised their voices. The government listened and deliberated, caught between competing interests in a single commodity chain where one company’s input is another’s cost burden.

A Two-Track Response

On December 26, 2025, Canada’s government registered three linked orders: an amendment to existing steel tariffs; modifications to the Import Control List; and a new Steel Derivative Goods Surtax Order. The timing was surgical. All three came into force immediately.

The first order tightens quotas on raw steel imports from countries without free trade agreements with Canada. Previously, these countries could ship 50% of their 2024 volumes duty-free. Now, only 20% qualifies for tariff-free entry. For nations with trade agreements not including the U.S. (such as those under CUSMA), the reduction is less severe: from 100% to 75% of baseline.

The second order, more dramatically, imposes a flat 25% surtax on steel derivative products: prefabricated buildings, wire, cables, chains, and fasteners. This is the mechanism that protects both Canadian steel producers and Canadian manufacturers who use that steel. The surtax applies to all nations equally, calculated on the duty value of imported goods and stacking on top of any existing tariffs.

The signal is unmistakable. Canada is not negotiating a retreat; it is restructuring its market.

The Carbon Calculus

Government documents reveal an environmental argument most observers missed. By replacing high-emission steel imports from China, Brazil, and India with domestic sources, Canada expects positive climate outcomes. The regulation impact analysis explicitly calculates that the shift improves Canada’s emissions profile while capturing market share for lower-carbon production. It is environmental policy dressed as trade defense, and policy written to endure.

The Mechanics of Control

To execute this strategy, Canada leans on a system of tariff-rate quotas (TRQs) and import licenses. Importers seeking to avoid the 50% surtax on raw steel must obtain shipment-specific permits from Global Affairs Canada. Once quota thresholds are reached, no more permits are issued. Steel can still enter, but at the punitive rate.

For derivative products, the surtax is simpler: it applies to all shipments of affected tariff classifications from all countries, creating uniform cost pressure across supply chains.

A Sunset Clause with Teeth

The government built in a conditional expiration. The amended steel tariff order is set to terminate on June 27, 2026, one year after the original order took effect. But the language is careful: it contains room for extension “when warranted.” The government also reserved the right to pursue company-specific relief requests for firms unable to source Canadian steel due to supply constraints or technical certification requirements, particularly in automotive and aerospace sectors.

This architecture suggests officials expect negotiation and movement in the interim. But they are betting that market pressure will drive change before June 27 arrives.

The Broader Landscape

Canada is not alone in this thinking. The European Commission, just two months earlier in October 2025, tightened its own tariff-rate quota framework for steel and proposed new reporting requirements. The U.S. has already expanded Section 232 tariffs to cover derivative products. Japan, South Korea, and others remain watchful.

What unfolded on December 31, 2025, therefore, was more than a Canadian response to American action. It was a statement about the shape of 21st-century trade: when market forces and national interests diverge, governments will stack tariffs until either negotiation succeeds or supply chains reroute. Carbon intensity, labor standards, and industrial capacity now sit alongside traditional trade law as variables in the equation.

For Canadian steel producers, relief arrives. For downstream manufacturers facing higher input costs, pain begins. For the global steel market already burdened by non-market policies in Asia, a new competitor has raised the price of entry.

Source Documents

Government of Canada, Department of Finance. (2025, December 26). Order Amending the Order Imposing a Surtax on the Importation of Certain Steel Goods (SOR/2025-266).

Government of Canada, Department of Foreign Affairs. (2025, December 26). Order Amending the Import Control List (2025-2).

Government of Canada, Department of Foreign Affairs. (2025, December 26). Steel Derivative Goods Surtax Order (SOR/2025-267).

Thank you for an excellent article. I now understand Canadian steel production and related trade matters. Happy New Year.

https://organon.substack.com/p/tariffed-with-the-same-brush-confronting?r=5rmgdf